On 13th October 2015, the Government of Thailand approved a fiscal stimulus package to boost the SMEs and revive the real estate markets. The Royal decree reducing the transfer fee for the sale of real property and the mortgage registration fee was published in the Royal Thai Government Gazette and is effective since 29th October 2015. The others measures are expected to be soon published.

Reduction of the Corporate Income Tax

The corporate income tax in Thailand is regulated by the Revenue Code B.E. 2481 (1938) as amended and the Royal Decrees issued under it. In anticipation of the launch of the ASEAN Economic Community on the 31st December 2015, the Government had reduced the corporate income tax rate from 30% to 23% for the accounting year of 2012 and to 20% for the accounting periods 2013-2015 on a temporary basis.

Under the new tax rate, the corporate income tax will be reduced to 20% on a permanent basis, making Thailand one of the most corporate tax friendly countries of the region.

The Cabinet also approved a bill to reduce further the corporate income tax rate for SMEs. To qualify as a SME, a company must (i) have a maximum paid up capital of THB5 million at the end of any accounting period and (ii) a maximum income of THB30 million in any accounting period.

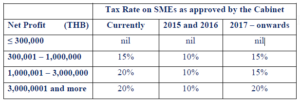

Under the new tax rate for SMEs, the net profit equal or less than THB300,000 will remain exempted from the corporate income tax. The corporate income tax rate will be reduced from 15% to 10% of the net profit over THB300,000 for the accounting years 2015 to 2016.

From the accounting year 2017, the corporate income tax rate for SMEs will be 15% of the net profit from THB300,001 to THB3,000,000 and 20% for the net profit over THB3,000,000. The net profit less than THB300,001 is not subject to the corporate income tax.

Tax Incentives for the Real Estate Market

The transfer of ownership of a real property, such as lands, households and condominium units was subject to an official transfer fee at the rate of 2% of the appraised value payable at the time of the registration of the transfer at the Land Office.

The registration of a mortgage was subject to a registration fee at the rate of 1% of the mortgage amount.

Under the new fee rate, the transfer fee and the mortgage registration fee for real properties are reduced to 0.01% for a period of 6 months.

The first-home buyers who buy a real property priced no more than THB3 million can deduct 20% of the real property value from their taxable income for a period of 5 years under the bill approved by the Cabinet. The Government hopes that these incentives will increase the number of real estate transactions in the forthcoming months.

Tax Exemptions for Venture Capital Funds

Venture capital fund companies that invest in SMEs will be exempted from the corporate income tax and the 10% withholding tax on dividends for a period of 10 years. Venture capital funds are a very important source of funding for SMEs because SMEs hardly have access to the capital market and the debt market. It is expected that this 10-year tax break for the venture capital funds will encourage the creation and the development of innovative companies in Thailand.

The information provided in this document is general in nature and may not apply to any specific situation. Specific advice should be sought before taking any action based on the information provided. Under no circumstances shall the authors or LawPlus Ltd. be liable for any direct or indirect, incidental or consequential loss or damage that results from the use of or the reliance upon the information contained in this document. Copyright © 2015 LawPlus Ltd.

The information provided in this document is general in nature and may not apply to any specific situation. Specific advice should be sought before taking any action based on the information provided. Under no circumstances shall LawPlus Ltd. and LawPlus Myanmar Ltd. or any of their directors, partners and lawyers be liable for any direct or indirect, incidental or consequential loss or damage that results from the use of or the reliance upon the information contained in this document. Copyright © 2016 to 2020 LawPlus Ltd.