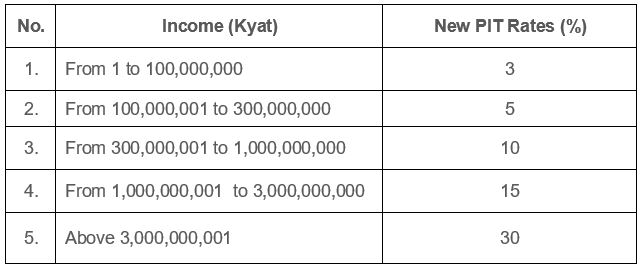

On 17th June 2021, the State Administration Council (“SAC”) enacted the SAC Law No. 20/2021 to amend the Union Tax Law 2020 (“UTL”) in relation to the personal income tax (“PIT”) rates. From 1st July 2021 to 30th September 2021, the PIT rates payable on the income from any undisclosed source are temporarily reduced to the new rates as follows:-

The PIT rates under the UTL before the reductions are 6% to 30%.

If a taxpayer can show the source of the income used for buying, constructing of property, acquiring or establishing a new business, or expanding the business, the income tax on such income shall be assessed and paid according to the tax rates specified under the UTL. If, however, the source of the income cannot be shown or disclosed, the subject income shall be assessed and paid according to the tax rates specified above separately from the income of which the source can be shown.

To see the archive of our past newsletters and articles pleas click here.

AUTHOR

Partner | yangon

Partner | yangon Associate | yangon

Associate | yangon

The information provided in this document is general in nature and may not apply to any specific situation. Specific advice should be sought before taking any action based on the information provided. Under no circumstances shall LawPlus Ltd. and LawPlus Myanmar Ltd. or any of their directors, partners and lawyers be liable for any direct or indirect, incidental or consequential loss or damage that results from the use of or the reliance upon the information contained in this document. Copyright © 2016 to 2020 LawPlus Ltd.