On 30th September 2021, the State Administration Council (“SAC”) issued the State Administration Council Law No. 21/2021 as the new Union Tax Law effective from 1st October 2021. The UTL changes the rates of the personal income tax, the corporate income tax, the tax on income from undisclosed sources, and the specific goods tax.

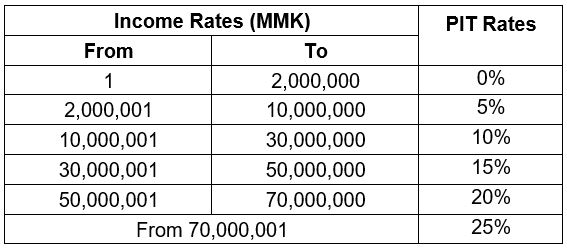

1. Personal Income Tax (“PIT”)

1.1 Any person, whose assessable income from salaries, professions, businesses or other sources after deduction of allowances is more than MMK4,800,000 per year, is subject to the PIT at the following rates:-

1.2 A Myanmar citizen residing abroad is subject to the PIT at the rate of 10% of his/her total assessable income in foreign currency with certain exceptions.

1.3 An individual taxpayer who has an assessable income as a rental fee from lease of land, buildings and apartments is subject to the PIT at 10% of the assessable income after the deductible deductions under the UTL. Such income will not be combined with other types of assessable incomes for tax calculation and no additional tax assessment will be made.

2. Corporate Income Tax (“CIT”)

2.1 A company registered in Myanmar, a state-owned enterprise, a business operated with an MIC permit and a cooperative are subject to the new CIT at the rate of 22% of their total net income.

2.2 A cooperative society established under the Cooperative Society Law 1992 is subject to the CIT at the rate of 22% of the net profit after deduction of permitted allowances.

2.3 Start-ups and SMEs are exempted from the CIT not exceeding MMK 10,000,000 for 3 consecutive years inclusive of the business commencement year.

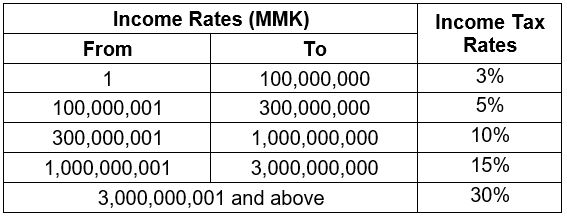

3. Undisclosed Source of Income

3.1 Taxpayer’s income, without disclosure of sources, used for buying, constructing or acquiring any capital assets or establishing a new business or expanding an existing business, less the portion of income the source of which can be disclosed, is subject to the tax at the rates listed below from 1st October 2021 to 31st March 2022.

3.2 The assessment of the undisclosed-source income tax will be made by 31st March 2022.

4. Specific Goods Tax (“SGT”)

4.1 Special commodities produced and sold in Myanmar are subject to the SGT calculated from their market prices or sales prices, whichever is higher. Section 11(a) of the UTL increases the SGT rates for cigarettes, cheroots, alcohol and wine:-

– Cigarette: MMK 10 up to 27 per stick;

– Cheroots: MMK 1 per stick;

– Liquor: 190/liter up to 60%;

– Wine: 92/liter up to 50%.

4.2 The SGT does not apply to local production and sale of tobacco leaf, cheroots and cigars if the total income does not exceed MMK 20,000,000.

4.3 The SGT exemption applies if the goods are imported under the temporary admission or drawback system in accordance with the customs procedures for goods imported for domestic consumption (without re-export) within the prescribed period.

5. Commercial Tax (“CT”)

5.1 Income from domestic sale or trading of commodities or services of cooperatives and private sectors is subject to the CT at the rates from 1% to 5% if they generate incomes more than MMK 50,000,000 per year with certain exceptions under the UTL, e.g. 5% for consultancy services and logistics services, 3% for hotel and long-term rent of government land and 1% for sales of gold.

5.2 45 kinds of commodities are not subject to the CT, e.g. rice, fresh fruits, raw meat, text books, medical plants, creamer, household mosquito repellents, jet fuel for domestic and international flights, machine and equipment for aircraft, and goods purchased by the UN Organizations operating in Myanmar.

5.3 33 kinds of service businesses are not subject to the CT, e.g. public transportation, educational services, healthcare services, financial services, life insurance, and services provided by the UN Organizations operating in Myanmar.

5.4 The CT exemption applies if the goods are imported under the temporary admission or drawback system in accordance with the customs procedures for goods imported for domestic consumption (without re-export) within the prescribed period.

To see the archive of our past newsletters and articles pleas click here.

AUTHOR

Partner | yangon

Partner | yangon Associate | yangon

Associate | yangon

The information provided in this document is general in nature and may not apply to any specific situation. Specific advice should be sought before taking any action based on the information provided. Under no circumstances shall LawPlus Ltd. and LawPlus Myanmar Ltd. or any of their directors, partners and lawyers be liable for any direct or indirect, incidental or consequential loss or damage that results from the use of or the reliance upon the information contained in this document. Copyright © 2016 to 2020 LawPlus Ltd.