The Ministry of Labor issued the Ministerial Regulation re Prescribing the Minimum and Maximum Wage Rates for Calculating the Social Security Fund Contributions of an Insured Person under Section 33 B.E. 2568 dated 11th December 2025 (“Ministerial Regulation”), effective on 1stJanuary 2026.

Prior to 1st January 2026, employers and employees were required to contribute to the Social Security Fund (“SSF”) at the rate of 5% of the employee’s wage, subject to the Maximum Wage Ceiling of THB 15,000 per month, resulting in the maximum monthly contribution of THB750.

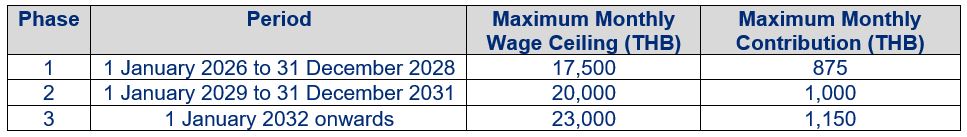

To align with the current economic conditions and to strengthen the financial sustainability of the SSF, the Ministerial Regulation increases the Maximum Wage Ceiling for calculating the maximum monthly contributions which employers and employees will contribute to the SSF in three phases as follows:

The minimum wage for calculation of the contributions which the Government will contribute to the SSF for each employee remains unchanged at THB 1,650 per month.

To see the archive of our past newsletters and articles please click here.

AUTHOR

Partner | bangkok

Partner | bangkok Associate | bangkok

Associate | bangkok

The information provided in this document is general in nature and may not apply to any specific situation. Specific advice should be sought before taking any action based on the information provided. Under no circumstances shall LawPlus Ltd. and LawPlus Myanmar Ltd. or any of their directors, partners and lawyers be liable for any direct or indirect, incidental or consequential loss or damage that results from the use of or the reliance upon the information contained in this document. Copyright © 2016 to 2020 LawPlus Ltd.