In accordance with BOI Notification No. 6/2568 re: Investment Promotion Measures for the Use of Local Content in EV and Electrical Appliance Industries dated 22nd July 2025, additional tax incentives are available to manufacturers that use local contents for manufacturing of their products, subject to the terms and conditions listed below.

Eligible Projects

Conditions

The eligible project can be a new project under a new BOI application or an existing project already promoted by the BOI but the period of the granted corporate income tax (CIT) exemption has not yet expired. The project can be located in any province in Thailand.

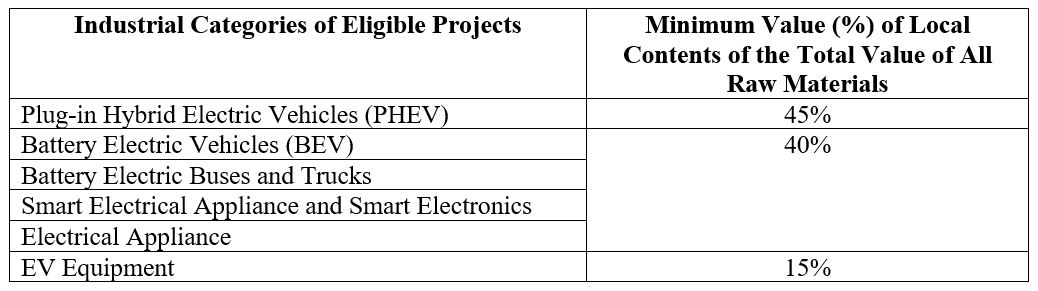

The products of the project must have been granted a Made in Thailand (MiT) certificate by the Federation of Thai Industries (FTI) and use Thailand local contents not less than the minimum value (%) of the total value of all raw materials listed in the table above.

The application must be filed with the BOI within the last working day of 2026 and the MiT certificate must be filed before the expiration of the existing CIT exemption period and before the final working day of 2027.

Rights and Benefits

50% reduction of the CIT on the net profits derived from the promoted project for an additional period of two years from the end of the granted CIT exemption period.

LawPlus Ltd.

19th February 2026

To see the archive of our past newsletters and articles please click here.

AUTHOR

Partner | bangkok

Partner | bangkok

The information provided in this document is general in nature and may not apply to any specific situation. Specific advice should be sought before taking any action based on the information provided. Under no circumstances shall LawPlus Ltd. and LawPlus Myanmar Ltd. or any of their directors, partners and lawyers be liable for any direct or indirect, incidental or consequential loss or damage that results from the use of or the reliance upon the information contained in this document. Copyright © 2016 to 2020 LawPlus Ltd.