Initial Coin Offerings (ICO) have captured tremendous public attention in Thailand in the past 6 months. This is mainly due to the dramatic swings in the value of existing major cryptocurrencies already trading in crypto markets during the final quarter of 2017 and the huge number of new ICOs launched and available to investors in Thailand in the past few months. The charts below illustrate how the capitalization of cryptocurrencies can fluctuate by half in less than 10 days. ICOs have created concerns and triggered actions of Thailand regulators particularly the Ministry of Finance (MOF), the Bank of Thailand (BOT) and the Securities and Exchange of Thailand (SEC). This article addresses the characteristics of cryptocurrencies and ICOs, their implications and relevant legal issues, and regulatory challenges from the perspective of Thailand and Thai law.

What Are Cryptocurrencies?

They are a new type of currency created, encrypted and transacted using blockchain technology. They are digital, virtual and decentralized, meaning cryptos are independent from and not backed by any government. Thus, they are not a “currency” in any traditional or legal sense. Many of them are not backed by any assets and have no intrinsic value, while others are backed by an asset or a project and capable of being a medium of exchange for goods and services.

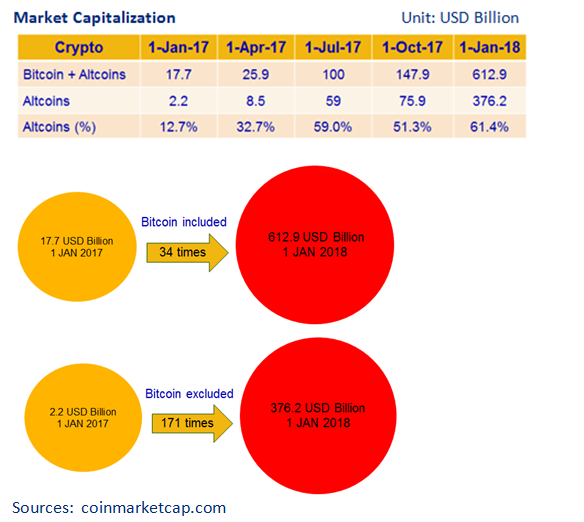

Cryptocurrencies first appeared in January 2009 when an unknown person or persons going by the name of “Satoshi Nakamoto” created 21 million units of Bitcoin (BTC) using blockchain technology and transfered 10 units to Hal Finney on 12 January 2009. Nobody knows who Satoshi Nakamoto is, but he made 18 million BTC available to investors at a very low value (1,578 Bitcoin per US$1). The first purchase made with Bitcoin was two trays of pizza for 10,000 Bitcoin in October 2009. In later years when other cryptos (collectively called as Altcoins) such as Ripple and Ethereum were created, Bitcoin could be exchanged in crypto-markets with other cryptos, and they could also be bought and sold against fiat currencies. Currently, over 1,400 cryptos have been launched globally, but Bitcoin remains the major crypto as it accounts for around 40% of the total market capitalization of all the cryptos while the value of the Altcoins (all the cryptos except for Bitcoin) accounts for around 60% of the total market capitalization.

As cryptos are decentralized and can be transacted peer-to-peer online quickly and at lower fees, most global governments, regulators, and established debt and equity institutions do not like them—in fact, they fear them and are trying to manage, control or outlaw them, so far without much success. No country recognizes them as a currency in a legal and traditional sense. A study of the attitudes and actions of 68 countries released on October 25, 2017 by Thomson reuters (https://blogs.thomsonreuters.com/answerson/world-cryptocurrencies-country/) revealed that these countries adopted a variety of positions in relation to BTC and other cryptos ranging from banning them to advocating them as a currency of the future. Some countries are creating or have a plan to create their own national cryptocurrencies (www.verdict.co.uk/author/amelia-heathman/). See the status of cryptos and ICOs in major markets in www.cointelegraph.com and www.investopedia.com/articles/forex/041515/countries-where-bitcoin-legal-illegal.asp.

Despite several uncertainties and risks related to cryptos, their capitalization still grew at eye-popping rates over the past year: 34 times for all cryptos, 171 times for all cryptos excluding Bitcoin.

In Thailand, cryptos are quite contentious. ICOs launched last year drew a lot of investments from individual investors in Thailand. Over 100 businesses in Thailand now accept BTC for payment of goods or services. New ICOs launched online by foreign issuers were welcomed by more and more Thai investors in a matter of days. In addition to BTC, some of the Altcoins known to and liked by investors in Thailand include, but are not limited to, Ethereum, Ripple, Litecoin, OmiseGo, and ZCoin.

Notably, at least two cryptos have been pre-launched in Thailand so far this year: BIG Token, which is decentralized and backed by real estate projects in Thailand and Vietnam with value of US$40 million (pre-launched on February 8); and JFIN Coin, which is also decentralized and backed by a fintech development project. JFIN Coin was pre-launched on February 14 as the “1st ICO by listed companies in Thailand.” It was a decided success: the pre-lauched 100 million JFIN coins (out of a planned 300 million coins) reportedly raised THB660 million within the first 55 hours of the pre-launch period, which was scheduled for 2 weeks. The issuer calls JFIN Coin a digital token / utility token and states in its White Paper that the funds raised will be used for developing a decentralized digital lending platform. As a result of the success of JFIN Coin, more than a dozen Thai companies are now saying they have plans to launch ICOs in 2018.

No Applicable Law for ICOs and Cryptos

Like most other countries, as of March 1, 2018 Thailand does not have any specific laws governing ICOs and cryptos. As a result, we are now pretty much in a “Wild West” situation when it comes to launching ICOs and investing in cryptos and digital tokens that are based in or related to Thailand. Issuers and investors make decisions and take actions at their own risk. The regulators have concerns and are well aware of risks involved. They view ICOs and cryptos as a risk and a threat to the stability of the national economy, the financial system and public investors. The MOF, the BOT and the SEC have issued formal and informal warnings to the public and financial institutions about risks that could come from or be related to ICOs and cryptos. They have also warned that ICOs could be a ground for money laundering and public frauds. To this point, on February 12, the BOT specifically asked financial institutions to refrain from getting involved with ICOs and cryptocurrencies.

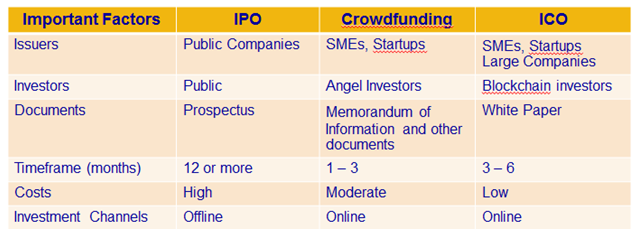

But despite potential risks and warnings from authorities, issuers view ICOs as beneficial because raising funds by ICO is easier, faster and cheaper when compared with obtaining traditional financing from either debt or equity markets. Issuers of ICOs can be SMEs, startups, or even established companies, and blockchain investors can be reached easily in any corner of the world via the Internet. An ICO takes about three to six months from the inception of the project to the launch of the ICO, while an IPO (Initial Public Offering) under the securities law can take 12 months or longer to complete and the IPO costs tend to be higher and the equity issued under the IPO can only reach a limited number of investors who invest practically offline. The table below compares ICOs with IPOs and Crowdfunding.

Despite the absence of directly applicable laws, the good news is that ICO issuers in most cases do take advice and direction from authorities and professional advisors. They make efforts and exercise due diligence to ensure that the White Paper for their ICO contains clear and sufficient facts and information in order to minimize the risk of being viewed as fraudulent, misleading, exaggerated or incomplete. For example, most White Papers include details on the general concept, business model, method of payment, payment flatform, mechanism for maintaining stability of the issued tokens, underlying project, project timeline, profile of issuer and related companies, the founding team, advisory team, partners, and legal issues and disclaimers. The legal issues involved can be related to the fact that the issued tokens are not legal currency, securities or assets, and whether the issuer will do KYC (know your client) and AML (anti-money laudering) checks against investors, to name a few.

What Is Next?

The Government of Thailand is cautiously receptive to ICOs and cryptos even though several regulatory and enforcement authorities have been constantly warning the public of risks which may arise from them. In September 2017 and January 2018, the SEC invited public consultations on their proposed regulatory approach to ICOs. The SEC proposed to recognize digital tokens issued under ICO as a new type of securities, i.e. the “Investment Participation” by the SEC issuing regulations under Section 4 (10) of the Securities and Exchange Act B.E. 2535 stating that such digital tokens are instruments representing rights, divided into units, each with highly standardized terms and conditions, issued for raising funds from the public and the holders have rights to participate in pooled benefits from pooled contributions collectively managed and investors have no control over day-to-day operation of the issuer. It should be noted, however, that the SEC is not planning to regulate all types of ICOs, especially if they don’t fall within the scope of the Investment Participation.

The SEC has also proposed that each ICO should be issued under advice of an ICO portal recognized by the SEC and each White Paper should have at least the objective or nature of the project for which the funds are being raised, the business model or business plan for the project, the type/legal structure of the entity to run the project, the team members/advisors and a statements of key risks and legal issues. In relation to investors, the SEC would like to limit the maximum investment by retail investors to 300,000 Baht per investor.

As of February 2018 a working team consisting of officials from the MOF, the BOT, the SEC, the Stock Exchange of Thailand (SET) and the Anti-Money Laundering Office (AMLO) is drafting the regulations mentioned above. The team said that such regulations could be expected in March 2018.

The good news for ICO issuers: it is unlikely that the regulations will outlaw or have negative retroactive effects against ICOs and digital tokens issued prior to issuance of these regulations.

Kowit Somwaiya is the Managing and Senior Partner of LawPlus Ltd. and LawPlus Myanmar Ltd. He can be contacted at kowit.somwaiya@lawplusltd.com.

AUTHOR

Senior Partner | bangkok

Senior Partner | bangkok

The information provided in this document is general in nature and may not apply to any specific situation. Specific advice should be sought before taking any action based on the information provided. Under no circumstances shall LawPlus Ltd. and LawPlus Myanmar Ltd. or any of their directors, partners and lawyers be liable for any direct or indirect, incidental or consequential loss or damage that results from the use of or the reliance upon the information contained in this document. Copyright © 2016 to 2020 LawPlus Ltd.