The National Legislative Assembly of Thailand passed the Property Tax Act B.E. 2562 (“Act”) into law on 16th November 2018. The Act was published in the Government Gazette on 12th March 2019. It has become effective on and from 13th March 2019, except for the new tax rates and their applications, which will become effective on 1st January 2020 onwards. The Act repealed and replaced the Household and Land Tax Act B.E. 2475 (A.D. 1932) as amended and other local property tax laws.

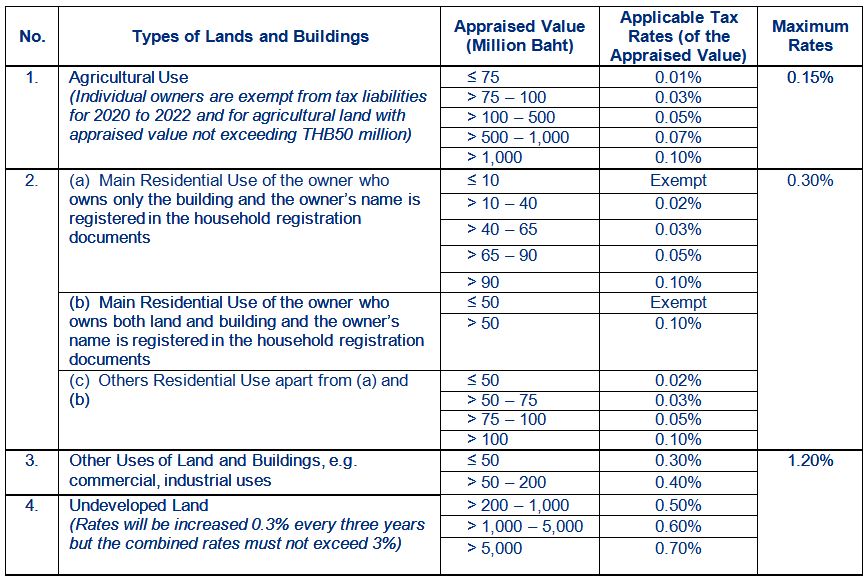

Under the Act, lands and buildings for agricultural, residential, commercial and industrial uses will be subject to tax at different rates pursuant to their types, uses and appraised values. The applicable tax rates for the 2020 to 2021 tax years are as shown in the table below. The tax rates for the tax years 2022 onwards will be specified by a Royal Decree at rates not to exceed the maximum rates mentioned below.

If the amount of tax payable in any of the 2020 to 2022 tax years is higher than the amount of tax payable in the previous year, the lower rate of the previous year will apply. In addition to the tax at the said lower rate, a portion of the differences between the higher tax amount and the lower tax amount will also be subject to tax, i.e. the portions that account for 25%, 50% and 75% of the differences for 2020, 2021 and 2022 respectively.

Tax assessment will be made in February and payable in April each year. If a taxpayer fails to pay the property tax, he can be subject to a penalty at 10% to 40% of the unpaid tax amount plus a monthly fine of 0.50% to 1% of the unpaid tax amount until the unpaid tax is paid in full.

AUTHOR

Senior Partner | bangkok

Senior Partner | bangkok - |-

- |-

The information provided in this document is general in nature and may not apply to any specific situation. Specific advice should be sought before taking any action based on the information provided. Under no circumstances shall LawPlus Ltd. and LawPlus Myanmar Ltd. or any of their directors, partners and lawyers be liable for any direct or indirect, incidental or consequential loss or damage that results from the use of or the reliance upon the information contained in this document. Copyright © 2016 to 2020 LawPlus Ltd.