On 19th December 2023, the Cabinet approved the resolution of the National Electric Vehicle Policy Committee Meeting No. 1/2023 dated 1st November 2023 to continue the subsidiaries for the second phase of electric vehicles promotion for battery electric vehicles (“BEV”) consisting of passenger cars (seating capacity not exceeding 10 persons), pickup trucks, and motorcycles (“EV 3.5”), effective from 1st January 2024 to 31st December 2027.

The EV 3.5 programme provides subsidies and tax benefits, i.e., import duty and excise tax reduction, as follows:-

Subsidies from the Thai Government

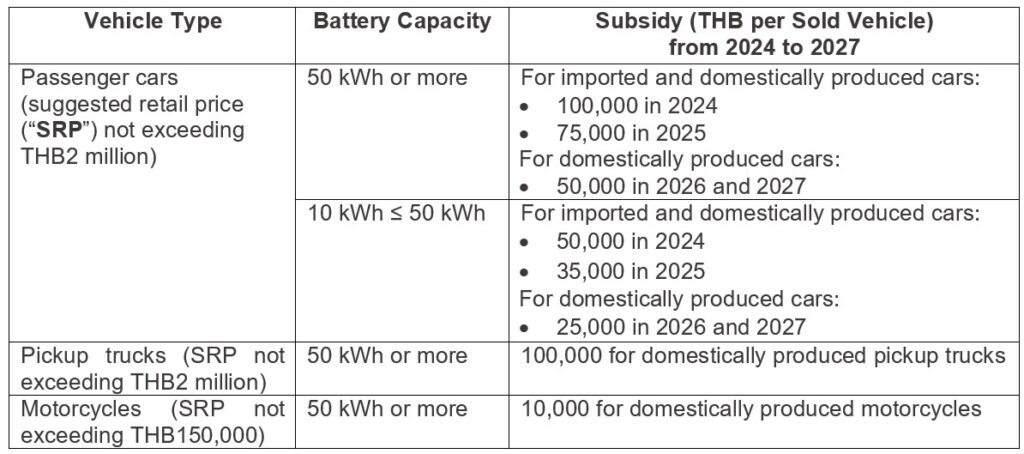

Under the Notification of the Excise Department re: Prescribing Criteria, Methods, and Conditions for the Eligibility under Measures to Support the Use of Electric Vehicles for Cars and Motorcycles, Second Phase dated 28th December 2023 (“ED Notification on Subsidies”), the Government provides subsidies to the eligible manufacturers and importers of BEV passenger cars, pickup trucks, and motorcycles, as shown in the table below:

Import Duty Reduction for Completely Built-Up (“CBU”) Passenger Cars

Under the Ministry of Finance Notification re: Duty Reduction and Exemption of the Completely Built-Up Battery Electric Vehicles dated 28th December 2023 (“MF Notification”), the importers of the CBU passenger cars that have the SRP not exceeding THB2 million per unit and comply with the requirement under the MF Notification will be entitled to an import duty reduction rate of up to 40% from 1st January 2024 to 31st December 2025.

Excise Tax Reduction

As part of the EV 3.5 package, the BEV passenger cars with an SRP not exceeding THB7 million per unit will be incentivized with the reduction of the excise tax from 8% and 10% to 2% in 2024 – 2027. The excise tax for BEV pickup trucks with the same criteria as those in the table above will be reduced from 10% to 0% in 2024 – 2025 and to 2% in 2026 and 2027. While the excise tax for the BEV motorcycles with the same criteria as those in the table in 1 above will be reduced from 5% and 10% to 1% from 2024 to 2027 (The Ministerial Regulation Prescribing the Excise Tariff Rate, B.E. 2560 (2017), as amended by the Ministerial Regulation Prescribing the Excise Tariff Rate (No. 23), B.E. 2565 (2022)).

As a condition for receiving subsidies and tax incentives, importers of CBU BEVs are required to domestically produce BEVs to offset the imports at the offset ratio of 1:2 by 2026 (import one BEV, produce two BEVs), or 1:3 by 2027 (import one BEV, produce three BEVs) and comply with the other requirements under the EV3.5 programme.

To see the archive of our past newsletters and articles please click here.

AUTHOR

Senior Partner | bangkok

Senior Partner | bangkok Associate | bangkok

Associate | bangkok

The information provided in this document is general in nature and may not apply to any specific situation. Specific advice should be sought before taking any action based on the information provided. Under no circumstances shall LawPlus Ltd. and LawPlus Myanmar Ltd. or any of their directors, partners and lawyers be liable for any direct or indirect, incidental or consequential loss or damage that results from the use of or the reliance upon the information contained in this document. Copyright © 2016 to 2020 LawPlus Ltd.